17 things to watch in 2017: See what’s in store for Houston this year

Posted by Surge Homes on in Media Coverage

For original news article, click here.

All eyes in Houston will be on the price of oil this year with a likely rebound helping energy companies rebuild after a bearish 2016.

Meanwhile, several other industries will face challenges of their own as everyone awaits what will happen under a new administration.

Trump

The stock market has rallied since the surprise November election of Donald Trump, but what will happen after his Jan. 20 inauguration remains to be seen.

No matter what fiscal-stimulus policies are put into place under the Trump administration, they will take time to implement.

However, small businesses are expected to benefit. The National Federation of Independent Business’ index jumped in December by the most points since 1980. And some companies are reviewing previously announced plans that may seem to draw an assault from Trump, who tweeted in December: “Any business that leaves our country for another country, fires its employees, builds a new factory or plant in the other country, and then thinks it will sell its product back into the US without retribution or consequence is WRONG!”

Meanwhile, the banking industry, which has struggled under Dodd-Frank laws, is looking forward to pro-growth policies, softer banking regulation and a lower corporate tax rate.

Despite all that, Trump has made discouraging remarks regarding defense contractors and pharmaceutical companies, saying that both industries need to rein in spending.

Downtown real estate

Urban planners are wrapping up years-long projects that aim to establish downtown Houston as a destination for locals as well as visitors. Downtown’s convention center district has been revamped and renamed as part of a $175 million makeover that started in 2014. Urban planning entities rebranded the area enclosed by the convention center, Discovery Green, the new Marriott Marquis and the Hilton Americas as “Avenida Houston” rather than the convention district. The street that separates the convention center from Discovery Green, Avenida de las Americas, has been confined to two lanes from eight in a move that made way for what is being dubbed restaurant row. Grotto from Landry’s, Bud’s Pitmaster BBQ, McAlister’s Deli, Pappadeaux Seafood Kitchen and Kulture from the owners of the Breakfast Klub will all open in that space. Meanwhile, six new restaurants, including a highly anticipated new concept called Xochi from Hugo Ortega, will open inside the Marriott Marquis.

However, whether Houstonians will frequent these restaurants is anyone’s guess.

“Downtown Houston is not the tourist destination like New York, Chicago or Philly. It’s different,” said Jazz Hamilton, first vice president with CBRE’s retail brokerage services group in Houston. “Houstonians are still not thrilled about driving to downtown and paying to park. (Retailers) are still catering to the business traveler that’s down there because of their office space or a conference center.”

Meanwhile, more people are choosing to live downtown. Multifamily developers are set to deliver the bulk of 5,000 new apartment units downtown, spurred by the city of Houston’s Downtown Living Initiative. Over the next 12 months, 3,644 units are expected to be delivered downtown, a 39 percent increase in the number of apartments, according to MPF Research. This downtown construction frenzy has resulted in plunging apartment occupancy and rental rates during 2016. Downtown apartment rents fell 6 percent to $1,883 per month and occupancy rates fell by a third to 58.4 percent — the most of any submarket across Houston, according to Transwestern. As apartment projects finish in 2017, watch how rental rates react downtown.

— Cara Smith and Paul Takahashi

Super Bowl’s impact on Houston’s image

On Feb. 5, the city of Houston hosts one of the most eagerly awaited sporting events on the planet — the 2017 Super Bowl. But for many, it’s what will happen after the confetti has cleared that will make the most difference.

Around $2 billion has been invested in Houston to prepare for the Super Bowl, including various beautification projects, infrastructure, commercial developments and green spaces. Organizations, such as Houston First and the Greater Houston Convention and Visitors Bureau, hope these projects will help build Houston’s reputation as a convention hot spot down the road.

While an economic impact report from BBVA Compass shows the city could gain millions in Super Bowl spending, the report said the biggest gain from the game could be to the city’s reputation. More than 100,000 people are expected to travel to Houston for the week leading up to the game, including leaders of some of the country’s largest companies, where the Greater Houston Partnership will try to sell Houston as a good place to work. Additionally, ESPN will broadcast more than 1,000 hours from its set in Midtown Park, and hundreds of journalists will be reporting from the Bayou City in the weeks leading up to the game.

— Joe Martin

What will happen to Houston’s health care jobs

The Houston health care industry is the second-largest employer in the city, trailing only behind government services, according to the Greater Houston Partnership. There’s nothing in 2017 that looks to change that, with the industry still expected to add 9,800 jobs in 2017. However, some question whether the health care systems can fill all of those jobs.

“If you go to Memorial Hermann, CHI St. Luke’s Health, etc., they have hundreds of jobs posted, but they don’t have the bodies to fill the positions,” said Patrick Jankowski, senior vice president of research for the GHP. “It’s not a change in the economy, but a change in the lack of people to hire.”

However, Houston’s health care systems are still expanding, including Houston Methodist’s $450 million hospital in The Woodlands, Texas Children’s Hospital’s new campus in The Woodlands, and Memorial Hermann’s $1 billion plus worth of projects around the greater Houston area. Those projects are still expected to be fully staffed when they open in 2017 and beyond, the GHP 2017 outlook says.

— Joe Martin

The 85th session of the Texas Lege

The Texas Legislature meets for a regular session in odd-numbered years, and there are several issues coming up in 2017 that are worth watching.

The state of Texas is expected to vote on a bill that would move regulation of ride-hailing services such as Uber and Lyft under state jurisdiction, rather than the existing municipal regulations. If this bill passes, Mayor Sylvester Turner’s rideshare regulations that he put together a couple of weeks ago would likely be negated.

Turner proposed a comprehensive pension plan aimed at setting the city on track to pay off $7.7 billion in unfunded pension liabilities. The proposal received near unanimous approval from the Houston City Council, and is expected to be voted on in the state legislature in 2017.

Among energy legislative concerns this year is the sunset review of the Texas Railroad Commission, which regulates Texas’ energy industry at the state level. The Sunset Commission has recommended in its review that the RRC be continued for 12 years, but it decided against recommending a name change that better reflects the RRC’s main functions, which have not included any responsibilities around railroads since 2005.

— Joe Martin and Joshua Mann

Houston arts projects have milestones

Several arts organizations have notable construction projects scheduled for groundbreaking or completion in 2017.

Two theaters — the Smart Financial Centre in Sugar Land and A.D. Players’ new Jeannette & L.M. George Theater in the Galleria area — will make their debuts early in the year. The $84 million Smart Financial Centre booked Jerry Seinfeldfor its grand opening celebration on Jan. 14, and A.D. Players will open its new theater in February with “To Kill a Mockingbird.”

The Menil Drawing Institute’s 30,150-square-foot building, which broke ground in Montrose in 2015, is scheduled to open Oct. 7. It’s part of the $40 million first phase of the Menil Collection’s 2009 master plan. Nearby, New York-based Architecture Research Office was selected in November to lead renovations to the Rothko Chapel and design an updated master plan for the chapel’s grounds on the Menil campus. The Rothko’s iconic “Broken Obelisk” sculpture recently was reinstalled after undergoing repairs.

The Museum of Fine Arts Houston broke ground on the first phase of a $450 million redevelopment of its 14-acre campus in 2015. Two portions of the project — the new Glassell School of Art building and the Brown Foundation Inc. Plaza — are expected to wrap up in late 2017 and open to the public in early 2018. Another portion, the Nancy and Rich Kinder Building, will break ground in 2017 and is slated to open in late 2019.

Rice University also plans to open its 50,000-square-foot Moody Center for the Arts in February and to break ground on the Shepherd School of Music’s new 84,000-square-foot music and opera building in September 2017. The latter project, which was announced in April 2014, is expected to be complete in July 2020.

— Olivia Pulsinelli

Houston-based retail faces out-of-town competition; High-end eateries to open

A bevy of out-of-towners challenged Houston-based retailers last year, and 2017 may mark the year of who’s in and who’s out.

- Pittsburgh-based Dick’s Sporting Goods (NYSE: DKS) rolled out six locations in the home of Katy-based Academy Sports + Outdoors with more plans to grow.

- Bethesda, Maryland-based Total Wine and More uncorked its first Houston-area alcoholic superstore with more locations stocked up, challenging Houston-based Spec’s Wines, Spirits and Finer Foods.

- Canton, Massachusetts-based Dunkin’ Brands Group Inc. (Nasdaq: DNKN) continues to expand in the Bayou City, threatening Houston-based Shipley Do-Nuts.

A few high-end restaurants are also slated for the Houston area in 2017. Chris Shepherd’s One Fifth plans to open early in the new year. Nobu, a wildly popular sushi restaurant, and New York-based Fig & Olive expects to open in fall 2017 in the Galleria mall. Mastro’s Steakhouse is also slated to open in the Galleria area.

— Jack Witthaus

Private equity investments

With the oil and gas industry beginning to turn around, many financial experts expect 2017 to be a heavy year for investment in Houston’s biggest sector.

There are a number of different ways for this to happen. First, as more and more companies begin to emerge from bankruptcy, an increasingly common trend has been debt-for-equity exchanges, where a buyer obtains the debt from a bankrupt company in exchange for a significant portion of the equity. This is in the hopes that in several years, the company is healthy and the oil markets continue to grow. Frequently, the buyers of the debt are private equity and hedge fund firms, according to Charles Beckham, a bankruptcy partner at Dallas-based Haynes and Boone LLP.

So far, there have been 31 instances of debt-for-equity exchange involving $46.7 billion in debt, according to Haynes and Boone.

Another avenue is through the public market. Maynard Holt, a co-founder of Houston investment bank Tudor, Pickering, Holt & Co., said there could be as many as 40 oil and gas IPOs in 2017, tripling the 2016 IPO market, driving billions in capital back into the industry.

Additionally, private equity has increasingly played a significant role in the Texas energy landscape. Private equity firms have been raising capital in 2016 in the hopes the market begins to turn in 2017, and investments in the hundreds of millions have already begun to take shape. If the market continues to move positive, look for private equity’s “dry powder” to get deployed.

— Joe Martin

Energy M&A

Financial pressure on oil and gas companies suffering under the downturn reached a fever pitch earlier in 2016, leading to massive spikes in bankruptcies filed and acquisitions agreed upon. And while bankruptcies have slowed to some extent as the industry looks ahead to 2017 with cautious optimism, there’s a pervasive sense among industry experts and participants that interest in mergers and acquisitions are still going strong.

In Deloitte LLP’s 2016 oil and gas industry survey, 59 percent of respondents expect moderate midstream consolidation in 2017, while 23 percent expected significant consolidation. PricewaterhouseCoopers LLP lists a huge increase toward the end of the year in agreements valued at over $1 billion, and a number of those deals are expected to close in 2017. Another thing to watch will be the companies coming out of Chapter 11 restructuring in 2017, often outfitted with new leadership and strategies.

— Joshua Mann

High-end hotels – to be or not to be

Experts agree that for a city of Houston’s size and caliber, it’s hard to believe there’s not a Ritz Carlton, Waldorf Astoria, W Hotel, and other high-end brands.

Some of these national top-tier hotels have been rumored to be eyeing Houston, such as a Loews Hotels and Resorts, which confirmed to HBJ in 2016 that the brand owns land in Uptown that could one day hold Houston’s first Loews hotel.

As for other high-end hotels, the rumor mill hasn’t stopped churning but no tangible deals have been executed publicly. A hotel flag — and high-end is expected — should be announced this year for Tilman Fertitta’s The Post Oak in the Galleria area, the River Oaks District’s Phase II or the mixed-use tower planned by Simon Property Group in the Galleria next to the new Saks Fifth Avenue store.

— Cara Smith

Energy exports to Mexico

Originally, 2017 would have been the year that Mexico opened its borders to oil and gas imports from third party companies, but Mexican President Enrique Pena Neto moved that up to April 2016 in a surprise announcement at CERAWeek back in February. Since then, several Houston companies have already begun work on assets intended to facilitate such exports. But some market participants have pointed out that there are still a lot of questions around the ways in which Mexico will regulate those imports. Whatever clarity 2017 does or doesn’t bring on that point will help determine whether exports to Mexico make a viable market around which Houston companies can build infrastructure in the near term.

— Joshua Mann

Construction jobs to dry up

One of the biggest trends for 2016 was the more than $30 billion in construction projects taking place in the petrochemical sector, largely on the east side of Houston. But with $20 billion worth of those projects expected to wrap up in 2017, and as commercial office space continues to come online, expect to see a heavy decrease in the number of construction jobs in Houston.

“We’re going to lose so many construction jobs next year,” said Patrick Jankowski, senior vice president of research for the Greater Houston Partnership. The GHP is already expecting the construction sector to be the hardest hit sector for next year, with more than 16,000 jobs expected to be lost.

Building permits have been on the decline since 2016 and the commercial office market is overbuilt, according to the GHP 2017 economic outlook report. That will lead to the construction sector largely being a drag on the economy rather than the previous buoy it once was.

While construction is likely to take a heavy hit, the Houston MSA is still expected to add 29,700 jobs in 2017, according to the GHP.

— Joe Martin

Boomer effect: Smaller homes, active adults and condos

As Baby Boomers begin to retire en masse, many are increasingly choosing to downsize from large single-family homes into more easy-to-maintain apartments. Anticipating an influx of older renters, several Houston developers are building smaller “garden-style” homes and apartments in age-restricted communities, designed for residents ages 55 years and older. These so-called active-adult apartments offer amenities and services, like pickleball courts and group outings, that cater to older residents.

Homebuilders and apartment developers are now gearing up for a new generation of retirees: Baby Boomers — the second-largest homebuying demographic nationally. Metrostudy Corp. estimates that half of all new home purchases nationally within the next five to 10 years will be made by active adults ages 55 and older. In 2017, watch how active adult communities like Taylor Morrison Home Corp.’s Bonterra and Pulte Group’s Del Webb master-planned communities as well as apartments like Greystar’s Overture and Stream Realty’s Solea apartments fare in 2017 despite the oil slump.

— Paul Takahashi

Oil slump leaves energy cos. shedding land, campuses

Energy companies have tried to shed heaps of Houston land throughout 2016. The question remains in 2017: Is there an appetite for old energy campuses and leftover land?

Among the campuses and land tracts for sale is a 21.3-acre tract located at 1500 Old Spanish Trail that’s being sold by Houston-based Shell Oil Co. The site is the largest contiguous redevelopment site in the Texas Medical Center area, according to a statement from Cushman & Wakefield.

Houston-based Halliburton Co. (NYSE: HAL) put its Oak Park campus up for sale in September. The 48-acre site is in Houston’s Westchase District at 10200 Bellaire Blvd. JLL Capital Markets is listing the property.

Chevron Corp. (NYSE: CVX) is selling 103 acres off the Grand Parkway, which has been hot for retail, and a 28-acre campus in Bellaire, a submarket known for its notorious space constraints. Cushman & Wakefield is marketing both properties. The Bellaire campus is located at 4800 Fournace Place.

Newmark Grubb Knight Frank is marketing a 24.5-acre tract of land at 400 West Sam Houston Parkway. The land was a former Dow Chemical Co. site and was acquired by Cameron International Corp. in 2013.

However, Duane Heckmann with Land Advisors Organization said that economic conditions won’t fundamentally make a tract more or less attractive than it would be in the boom times.

“In actuality, good real estate is good real estate, and it’s always good real estate,” Heckmann said in July.

— Cara Smith

Red hot suburb: Sugar Land

Sugar Land is experiencing a perfect storm of growth.

First, the city council approved plans to anex the nearby areas of New Territory and Greatwood, which will add 3,850 acres to Sugar Land and boost its population by 34 percent when it takes effect in December 2017. With the acquired areas, the city can grow its tax base and add funds to its coffers, making it easier to borrow for projects. One very large project in the works involves oil field services giant Schlumberger Ltd. (NYSE: SLB), which plans to move its North America headquarters to Sugar Land by 2019. Schlumberger will infuse $200 million into building a new campus and will move 517 jobs to the suburb. As part of its incentives with the city of Sugar Land, Schlumberger won’t pay property taxes for 10 years.

Meanwhile, Sugar Land’s brand new $84 million Smart Financial Centre has been making headlines with multiple big-name acts such as Jerry Seinfeld, Don Henley and Steve Martin with Martin Short. The venue can fit crowds between 1,900 and 6,400 people due to walls that move in and curtains that hide seats, enabling the theater to contract and expand when necessary. Only a handful of venues in the U.S. have this kind of scale, said Randy Bloom, vice president and general manager.

— Emily Wilkinson

Record-breaking small business loans

This year is expected to be a bang-up year for small businesses, according to the U.S. Small Business Administration Houston District Office. Houston small business loan volumes have been breaking records for years now, but the SBA predicts that 2017 will be the year small business loan volume finally breeches $1 billion in total guarantees.

“Considering all the things we hear about how Houston’s economy is suffering, this is an obvious statement that small businesses are growing,” said Tim Jeffcoat, Houston SBA district director. “They are not borrowing if they are not growing.”

Total SBA loan volume in Houston increased by nearly 20 percent in 2016 to just under $1 billion at $963.5 million. Health care and retail small businesses led the pack in terms of volume of loans and number of loans granted, while exporting companies also saw a more than 92 percent increase in loan activity. The SBA expects to see comparable growth for loans in export-focused businesses and continued high volumes for the health care industry, Jeffcoat said, which will help small business lending reach the $1 billion benchmark.

— Laura Furr

Foreign developers invest in Houston residential

Foreign investors have long flocked to Houston, attracted to its booming business, lack of zoning and affordable cost of living. But in recent years, foreign developers — particularly from China and Canada — have begun making their first foray into U.S. development, and they are starting in the Bayou City.

Tianqing Real Estate Development LLC — the U.S. subsidiary of Tianqing Group Real Estate Co. Ltd., one of the largest real estate developers in China — has partnered with Houston-based DC Partners to develop a $500 million mixed-use project near Buffalo Bayou Park. American Modern Green LLC — the Houston-based subsidiary of Modern Land of China — plans to develop Ivy District, a $300 million mixed-use project in Pearland. And McKinley Development Co. Ltd. — the Houston-based subsidiary of Yihai Group of China — plans to break ground in 2017 on a new master-planned community in Cleveland. Canadian developers, Empire and Surge Homes, are also making headway in Houston’s residential sphere, building master-planned communities, single-family homes and condominiums.

Despite the oil slump, these foreign investors see an opportunity to develop in Houston. It’s a testament to their faith in the future of the Bayou City.

— Paul Takahashi

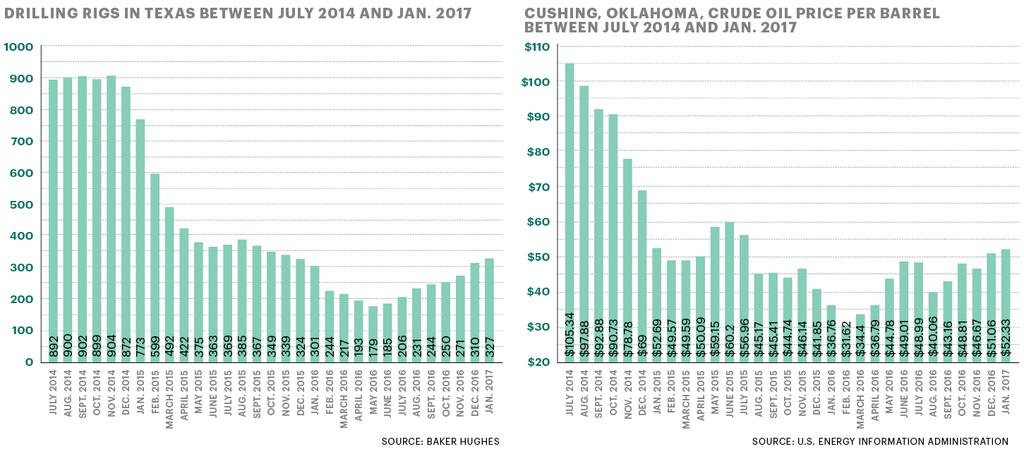

What will the price of oil do in 2017?

The oil industry has had an interesting couple of years, to say the least, but many of its participants are looking to 2017 with a sense of cautious optimism.

And that caution is key — many of these same people had their first set of hopes dashed in mid-2015 after a brief price recovery to more than $60 per barrel collapsed, eventually leading to the lowest point in the downturn when prices fell into the mid-$20s per barrel.

But there are reasons to think that this time, optimism might be better placed. For one thing, merger and acquisition volume rose after the first quarter of 2016, indicating a return to normalcy, said Doug Meier, who leads PricewaterhouseCoopers’ U.S. oil and gas deals division from Houston.

“The activity levels that we saw in 2015 and the first quarter of 2016 were, by historical norms, suppressed,” Meier said. “What we’re seeing now is not an abnormally high level of activity. It’s starting to manifest just the beginning of the recovery.”

For another thing, OPEC decided late in 2016 that it would finally cut some of its oil production. Even if the syndicate doesn’t entirely deliver on the commitment, that should help global inventories draw down and make room for higher prices, said John England, Deloitte LLP’s U.S. energy and resources leader, in the firm’s 2017 oil and gas outlook.

“I’d characterize 2017 as ‘the slow road back,’” England said.

And other analysts are looking to 2017 for a recovery as well. Wood Mackenzie is forecasting that U.S. independent oil producers could increase investment by more than 25 percent if prices average above $50 per barrel in the year, the company said in a press release.

“Overall 2017 will be a year of stability and opportunity for oil and gas companies in positions of financial strength. More players will look at opportunities to adapt and grow their portfolios,” said Tom Ellacott, senior vice president of corporate analysis research at Wood Mackenzie, in the release.

— Joshua Mann

Overheard: The price of oil in 2017

Craig Peus, CEO, Gravity Midstream

Gravity was founded with private equity backing from EnCap Flatrock in 2013, and it acquired its first and only facility in June of 2015, a little less than eight months before the deepest trench in the downturn. It’s employee head count peaked at 48 before it fell back to 32 as of December.

Peter Duncan, CEO, MicroSeismic

Peter Duncan founded MicroSeismic Inc. in 2003 and led the company through a period of explosive growth before stepping aside as CEO to become the company’s chairman in 2014. But plunging oil prices and a sliding rig count drew him back to direct leadership as the company saw its revenue and workforce dwindle to about a quarter of what it once was.

“To me, today seems normal. The abnormality was the boom we were seeing. This feels like your normal struggle, where you’re dealing day-to-day with people on tight budgets. There’s a project flow, and you lose a few, and you win some.”

Michael Reeves, CEO, Rubicon

Rubicon Oilfield International Holdings got its start with a $300 million line of equity from Warburg Pincus LLC in December 2015. The company was able to take advantage of its entry into the market during the worst part of the downturn to snap up five acquisitions, many of which were fueled in part by debt pressure on the acquisition targets. Now that much of the market expects a recovery, Rubicon is well-positioned to reap the rewards of its investments.

“I suspect we will see some alleviation of the debt pressure on these businesses. Banks will start to see a little bit of light at the end of the tunnel. If I were to forecast, I think we have a window of opportunity to continue acquisition at this type of valuation range for probably another six months. I’d be surprised if that window extends out beyond then.”